Artificial Intelligence has transitioned from a niche tech sector to the engine driving the global economy. From the hardware powering neural networks to the software automating enterprise workflows, AI is the most significant investment theme of the decade.

Naturally, investors are searching for a benchmark to track this growth. The question everyone is asking is: Is there an AI stock index?

The answer is more nuanced than a simple “yes” or “no.”

The Search for the “Official” AI Index

If you are looking for an official, globally recognized index like the S&P 500 or the Dow Jones Industrial Average specifically for AI, you won’t find one.

Unlike traditional sectors—like Utilities or Energy—AI does not have a single classification code. This is because AI is a horizontal technology. It isn’t just one industry; it is a capability being integrated into every industry, from biotech to long-haul trucking.

Why a single AI index is hard to build:

- Sector Overlap: Is a company that makes AI chips a “Semiconductor” company or an “AI” company? (It’s both).

- “AI-Washing”: Many legacy companies claim to be “AI-driven” in marketing materials, but their revenue says otherwise.

- Rapid Evolution: The AI landscape changes so fast that a static list of stocks becomes obsolete in six months.

So, How Do You Track the AI Market?

Since there is no “official” authority, the market relies on constructed indices. These are curated, rules-based baskets of stocks built by research firms and data providers.

However, not all AI indices are created equal. Most traditional tech ETFs and indices are market-cap weighted, meaning they are dominated by just three or four “Magnificent 7” giants. While these companies are important, they don’t tell the whole story of the AI revolution.

Investorean’s AI Proprietary Indices

One of the modern approaches to tracking this space comes from Investorean. Rather than trying to cram the entire AI world into one box, they provide a series of specialized AI filters designed for the modern investor.

Their methodology addresses the two biggest flaws in traditional indexing:

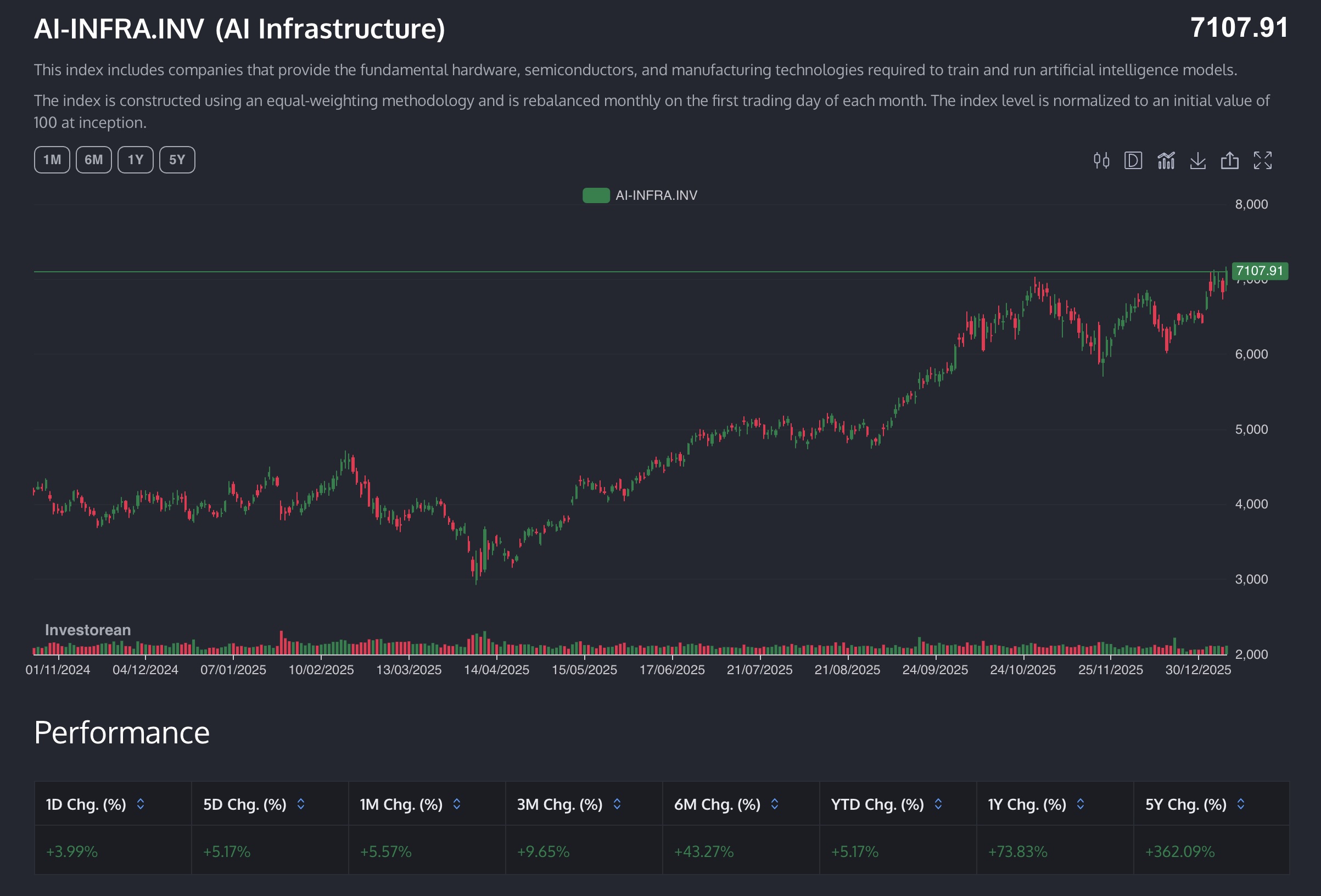

- The Power of Equal-Weighting

Most indices give the most “weight” to the biggest companies. Investorean utilizes an equal-weight construction. This ensures that high-growth, mid-sized AI disruptors have the same voice as the tech titans. It gives you a much clearer view of the breadth of the AI market, not just the performance of the top 1%.

- High-Frequency Rebalancing

In AI, a year is an eternity. A company that leads in Large Language Models (LLMs) today could be displaced by a new architecture tomorrow. Investorean indices are rebalanced on a monthly basis (on the first trading day of each month). This ensures the data reflects the current state of the market, not where the market was six months ago.

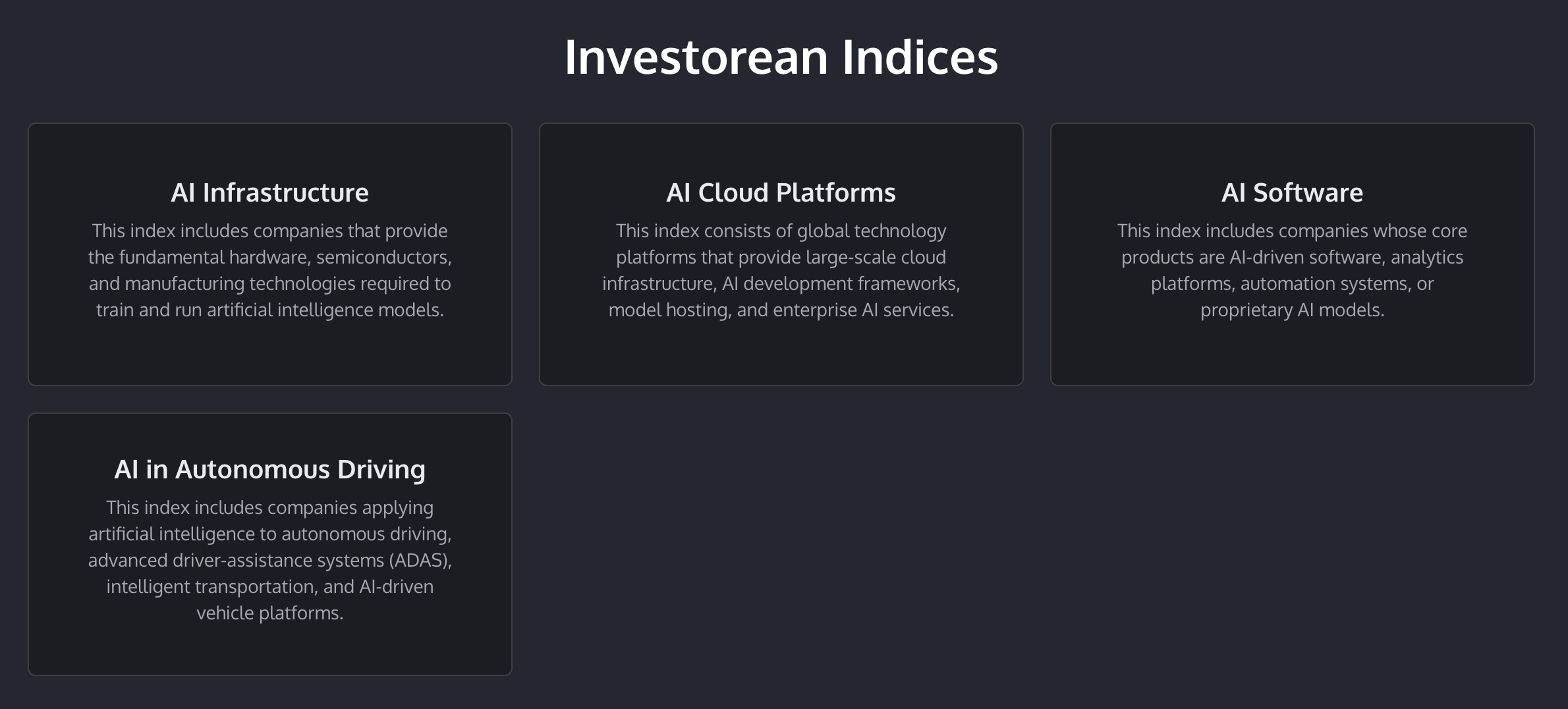

Investorean currently provides 4 different AI indices to track artificial intelligence dynamics on the stock market

- AI Infrastructure: Hardware and power to run the AI ecosystem

- AI Cloud Platforms: Technology platforms providing large-scale cloud infrastructure including model hosting and enterprise-focused AI services

- AI Software: SaaS companies heavily relying on AI and leveraging it in their business models

- AI in Autonomous Driving: Companies that are focused on robotics and modern autonomous driving technologies

Important: These are Research Tools, Not Direct Trades

It is crucial for investors to understand that these specialized indices, specifically those on the Investorean platform, are currently for informational and educational purposes only. You cannot trade them directly on an exchange like an ETF. Instead, they serve as a market compass.

How to use an AI index to build your portfolio

- Spot Trends: Compare different baskets (e.g., AI Infrastructure vs. AI Platforms) to see where the “smart money” is moving.

- Discovery: Use the index as a pre-vetted shortlist of companies that have passed strict AI-relevance filters.

- Manual Selection: Once you see the dynamics within an index, you can manually select and purchase the individual stocks through your own brokerage that align with your specific goals.

Conclusion

Is there an AI stock index? There isn’t one official benchmark, but there are sophisticated, methodology-driven research indices that are far more useful for the active investor. By looking past the “big names” and utilizing tools that offer equal-weighted, monthly-updated data, you can move from “chasing the hype” to “understanding the system.” If you want to see where the AI economy is actually heading, exploring the multi-index approach at Investorean is the place to start.